Keeping the Nexus Between the Borrowing and the Expenditure

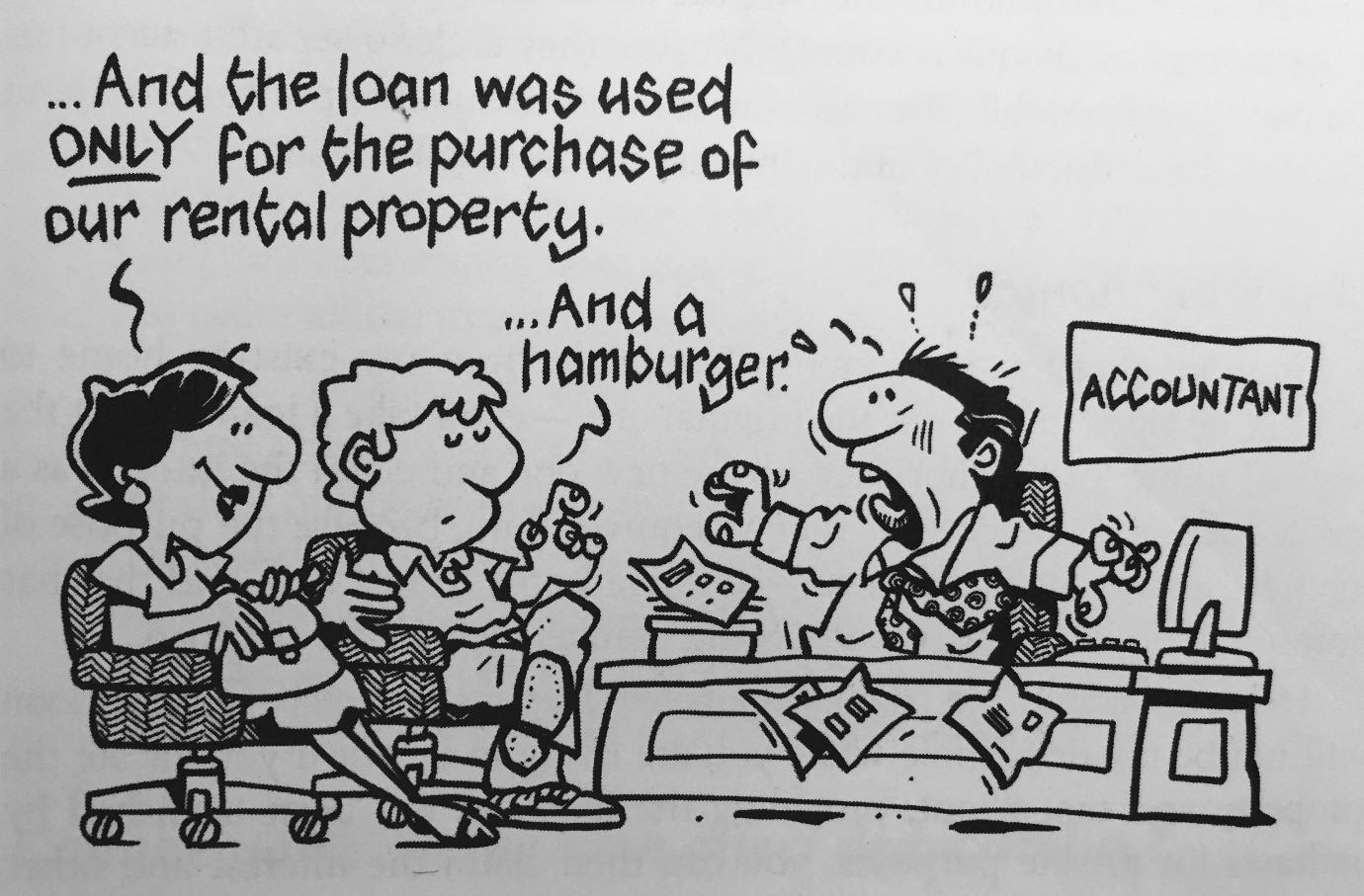

What the borrowed money is used to buy determines whether the interest on the loan is tax deductible. That is the basic rule. The link between the borrowing and the expenditure is called the nexus. This nexus needs to be very clear. You need to be able to show exactly how the money borrowed was used to purchase an asset that is producing income. For the interest on a loan to be tax deductible it must be a cost of earning taxable income.

Mixed Purpose Borrowings:

TR 2000/2 provides us with some guidelines for when a loan is used for multiple purposes. Basically, each draw down must be apportioned between deductible and non deductible purpose, keeping a running balance. The default position is non deductible, the nexus is what will get you across the line to deductible. When interest is charged it is apportioned pro rata between the deductible and non deductible purpose.

The kicker is any repayments off the loan must be apportioned on the same basis as the interest. This means you can never concentrate on paying off the non deductible portion. The only exception is when the repayment comes from the sale proceeds of one of the items the loan was used for. Then you can reduce the running balance that was originally generated from buying that asset.

Mixed Purpose Offset Accounts.

TR 2000/2 only applies to borrowings, loan accounts. An offset account is a savings account. A principle established in Domjan’s case is that once borrowed funds are mixed with private funds the nexus is lost.

Wilma Domjan withdrew money from her loan, deposited it into her cheque account and then wrote cheques to pay for work done on her rental property. In all but one case there were already private funds sitting in the cheque account. The court ruled the nexus between the borrowings and the rental property was lost. The borrowed funds were mixed with private funds, so the borrowings were for private purposes, no tax deduction on that portion of the loan interest. There was one exception when she drew money from the loan account and deposited it into her cheque account, there were no other funds in the cheque account at the time of the deposit right through to when the cheque, for rental property repairs, cleared. In this case the court decided that that borrowing was for tax deductible purposes.

Accordingly, you may get away with drawing loan funds down into an offset account to very promptly pay for a tax deductible expense if the account has nothing else in it during that time. Don’t let the money sit around while you look for a property etc, just in case the ATO views them as having become savings. Further, do not deposit anything else in that account while the borrowed funds are there, not even rent and certainly don’t draw on it for private purposes, not even a little.

Don’t think that good record keeping will help. Wilma Domjan was commended on her record keeping.

We would prefer it if borrowed funds were never placed in an offset account. If at all possible, pay direct from the loan account.

If you would like to know more about when you can claim interest as a tax deduction there are lot of interesting articles in our claimable loans booklet https://www.bantacs.com.au/booklets/Claimable_Loans_Booklet.pdf

Also follow our property page on https://www.facebook.com/BANTACSpropertypage/

Julia's Blog

Julia's Blog